Want to get a complete breakdown of where your money goes? Use our Maryland pay stub calculator to generate 100% accurate paychecks in seconds. It fits your needs whether you are an employee, freelancer, or own a multi-store business. You can always access paycheck by state wherever you work in the USA.

Simplifying the Way Maryland Paychecks Work

For those less aware of the accounting and math that goes into payroll calculations, it is difficult to attempt a DIY check stub. Not anymore! Our Maryland payroll calculator is your handy tool for deriving net pay from gross pay, with a transparent breakdown on how the amount is calculated. You can see well-classified deductions, taxes, and withholdings (pre-tax and post-tax), thus getting the exact YTD. It can then be used for paying taxes, getting financial credits approved, renting homes, buying a car on loan, and whatnot.

At checkstubgenerator.com, all the paystub makers are alike. No matter if you own a startup, small business, large enterprise, or are a self-employed individual. Even Maryland employees can verify if their provided paystub is error-free or create their own copy (if it is arriving late this pay period due to some reasons and needed urgently!).

Maryland hourly paycheck calculator

Use our check stub generator, one of the best tools ever for estimating total earnings based on the number of hours worked. At times, it is tricky to calculate earnings considering overtime, bonus, or multiple jobs. With our tool, when you enter the total number of hours worked, hourly rate, and pay frequency, you’ll instantly get net earnings accordingly.

Go for it if you are self-employed in Maryland or have hourly workers at your service.

Maryland salary paycheck calculator

Businesses can now generate a pay stub online without hiring a professional, thus maintaining the consistency of providing paychecks to the employees. Our tool calculates salary paychecks in no time with taxes, insurance, benefits, etc, deductions and withholdings, whether required for verifying income or recordkeeping. The best part – they can be customised from a variety of paystub template designs alongside provision for adding the company logo. A professional payroll it is!

How much is tax in Maryland?

Maryland income tax is progressive, varying from 2% to 5.75% according to the level of income. In addition, the counties here have different local income taxes ranging from 2.25% to 3.20%. This means the taxes in Maryland include federal, state, and local income tax.

Income tax brackets in Maryland

As discussed, Maryland income tax applies to the earnings. Here is the detailed view:

• 2% on the first $1,000

• 3% on $1,001–$2,000

• 4% on $2,001–$3,000

• 4.75% on $3,001–$100,000

• 5% on $100,001–$125,000

• 5.25% on $125,001–$150,000

• 5.5% on $150,001–$250,000

• 5.75% on income above $250,000

Try our Maryland income tax calculator to get the deductions and take-home pay as per your earnings.

How does the Maryland tax calculator help?

Our tax calculator for Maryland is an all-inclusive tool designed by professional accountants to help you plan your finances way better than before. It gives you a realistic figure of Maryland taxes by calculating federal, state, and local income taxes, FICA (Social Security & Medicare), and any pre-tax withholdings or benefits. It is preferred for reviewing pay stubs, ensuring their precision, and achieving the “peace of mind” state.

Maryland employees & contractors can thus ensure accuracy, save time, and money for creating a legally accepted pay statement.

Get your take-home pay calculator Maryland instantly with CheckStubGenerator.

With professional tools like checkstubgenerator.com and a detailed guide related to FAQs on creating a paystub online, it becomes fast and smooth to automate payroll. Get well-formatted paystubs that help in tracking income without any signup or hefty investment. With full privacy taken care of, your check stub is dispatched instantly via email, which can then be utilised as required. Save/download it right away or keep the PDF copy saved for later use.

FAQs on Maryland paycheck calculator

What is the minimum wage for Maryland?

Maryland’s minimum wage is $15 per hour.

How to calculate a paycheck in Maryland?

It is very simple to calculate a paycheck for those working in Maryland City. Get your gross earnings, tax filing status, and pay frequency legit. Use professional-approved tools like checkstubgenerator.com and select the state as “Maryland” from the dropdown, and the rest will be taken care of. Your paycheck will be calculated instantly.

How much tax is deducted from a paycheck Maryland?

Around 15% to 25% of your total income goes into Maryland taxes, according to the state, federal, and local income tax deductions.

What is the official Maryland tax website?

Visit Maryland Comptroller’s Official Website for the latest tax updates, find official rates, forms, and more.

Is the online paycheck calculator Maryland considered valid?

Yes, but only if you choose reliable and genuine ones like adp Maryland paycheck calculator, checkstubgenerator.com, etc.

Create your stub now

Maryland Paycheck Calculator

Maryland Paycheck Calculator

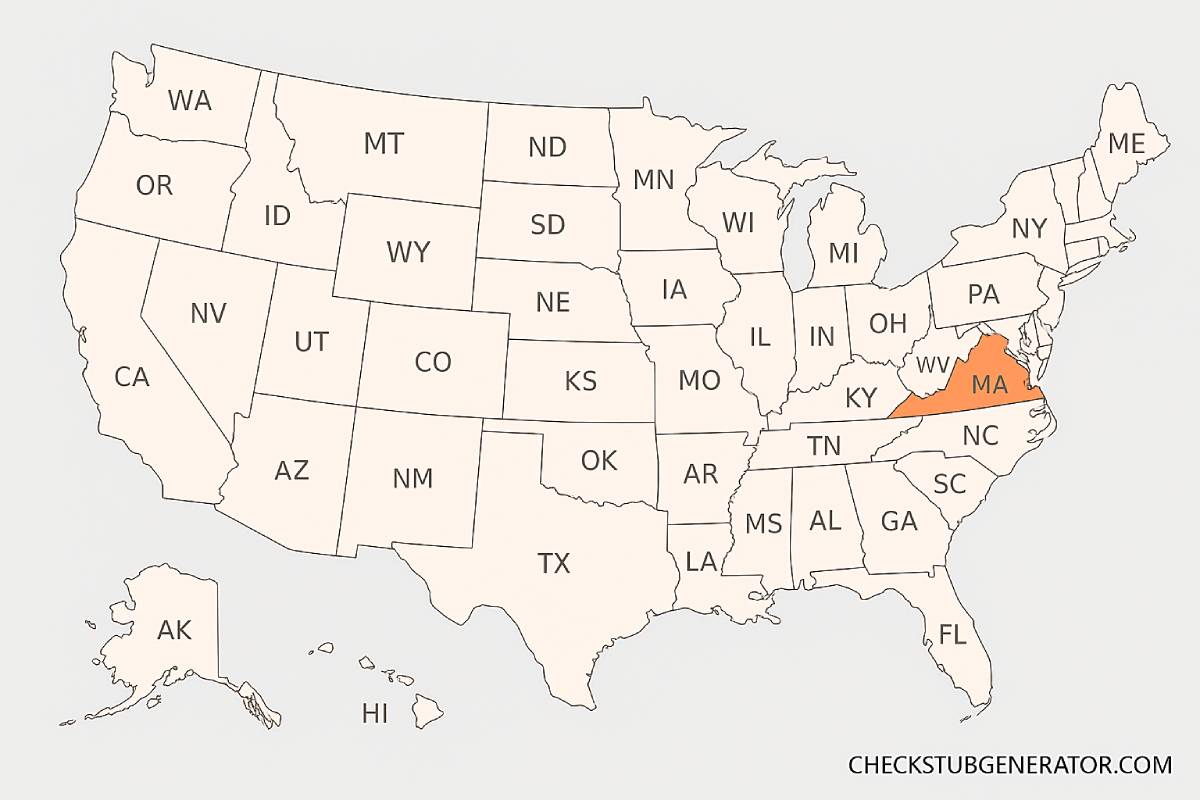

Calculate Your Paycheck Across Different States